- Consumer Products

- Energy & Natural Resources

- Education Sector

- Insurance Services

- Financial Services

- Healthcare Sector

- Manufacturing

- Not For Profit

- Public Sector

- Real Estate & Construction Sector

- Technology, Media & Telecommunications

- Travel, Tourism & Leisure

- Food and Restaurant

- Professional Services

-

Business Risk Service

Organisations must understand and manage risk and seek an appropriate balance between risk and opportunities.

-

Transaction Advisory, M& A, Business Consultancy

Transaction Advisory, M& A, Business Consultancy

-

IT Advisory

IT Advisory

-

Business Process Solutions

Business Process Solutions

-

Managing the VAT Audit

Managing the VAT Audit

-

Transfer Pricing

Global transfer pricing is all about understanding your business and the value drivers of your industry in an ever-changing environment.

2018 Middle East Regional Meeting in Kuwait

Grant Thornton Abdulaal Managing Partner Jassim Abdulaal, together with Senior Partner Jatin Karia attended the 2018 Middle East Regional Meeting in Kuwait on 24th April 2018.

The annual regional meeting was graced by Grant Thornton global CEO Peter Bodin, with about 50 leaders from Grant Thornton member firms in the Middle East.

Among the topics tackled by Bodin during the meeting were: gender equality in the workplace leading to long term sustainability, transforming businesses for growing in the global economy, impact of technology on businesses, facing cyber threats, and change management in the business

Grant Thornton holds IFRS 17 Insurance Contracts seminar

Grant Thornton Abdulaal, in association with BIA and BIBF, hosted a successful IFRS 17 Insurance Contracts seminar for the Bahrain Insurance Industry on 14 May 2018. The event, which witnessed full attendance by key representatives of the insurance industry in Bahrain, including the CBB, was held at BIBF in Juffair.

The IFRS 17 seminar covered topics including how the new accounting standard will impact the Bahrain Insurance and Reinsurance market, as well as the challenges many insurance companies face adopting IFRS 9 Financial Instruments at the same time as IFRS 17 Insurance Contracts.

Grant Thornton Abdulaal launches its Tax Advisory (VAT) service line

With the Gulf Co-operation council’s decision to adopt VAT across the region, Grant Thornton Abdulaal has introduced its Tax Advisory (VAT) service line. We introduce Suresh Nandlal Rohira, National Leader – Indirect Tax, and Nirav Rajput, Manager, working together with their team of VAT consultants.

Suresh has 24 years of experience in advising Indian and foreign multinationals on matters pertaining to VAT, Goods and Services Tax (GST) and other Indirect Tax Laws. He has rich experience on European VAT laws, Anti-dumping and Anti-subsidy Laws in the European Region.

Nirav is a qualified Chartered Accountant with more than 6 years of experience relating to Indian GST, Value Added Tax and Customs and UAE VAT. Nirav has provided advisory support in assessing the VAT impact on businesses, including transaction restructuring to mitigate tax risk and cost, as well as steering VAT implementation for UAE clients

VAT e-learning module launched

Grant Thornton Abdulaal has launched a new interactive e-learning module to educate businesses about the proposed VAT regime.

The e-module is a digital utility which explains the basic principles of the VAT to users. It is targeted towards business users who wish to learn the mechanics of VAT. It also contains a short quiz to help users test their understanding about the subject and set them on the right course of action to understand the new tax regime, its impact on their business, as well as regulatory and compliance requirements.

Grant Thornton Abdulaal will provide a certificate to those who will successfully complete the course. The e-module can be requested from the firm by sending an email to vat@bh.gt.com

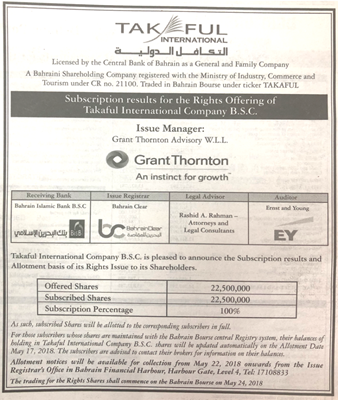

Grant Thornton is the Issue Manager for the Rights Offering of Takaful International

IFRS Global Insights

Navigate the complexity of the IASB Standards so you can focus your time and effort on running your business.